Are you looking for an easy way to track and manage your finances? Look no further because iFinance 5 is here to help. This finance manager will give you the edge that it takes to stay on top of your budget and make smart financial decisions.

With its powerful software suite, intuitive interface, and bank-grade encryption technology, iFinance 5 puts all the tools you need at your fingertips to take control of your money in an organized and secure fashion. Read on to learn more about what this finance management app offers!

Introducing iFinance 5

iFinance 5 is the ultimate personal finance manager designed to help you take control of your finances. This powerful tool features a suite of software that provides an intuitive, easy-to-use interface and bank-grade encryption technology so that you can access and manage your financial information securely.

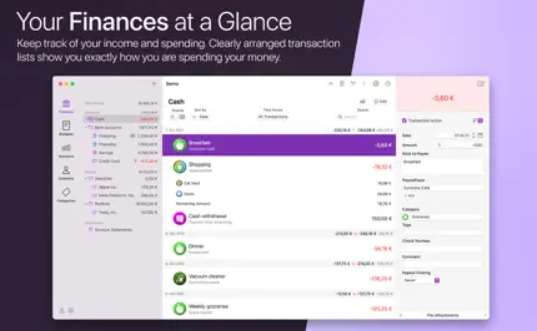

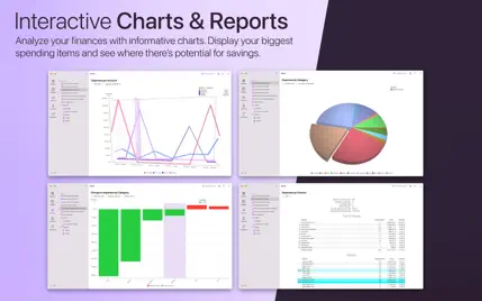

With iFinance 5, you always have the latest info, detailed reports, and charts to help you better understand your financial situation. Manage budgets, track expenses, view reports on the go, and create customized plans for future spending. With iFinance 5, handling money has always been challenging!

How to set up your account and get started tracking your finances

First, you need to download iFinance 5 from the App Store. Once the app is installed on your device, creating an account is time.

You only need to provide basic information such as name and email address. After verifying your account with a one-time SMS code, you can use iFinance 5 to track your finances.

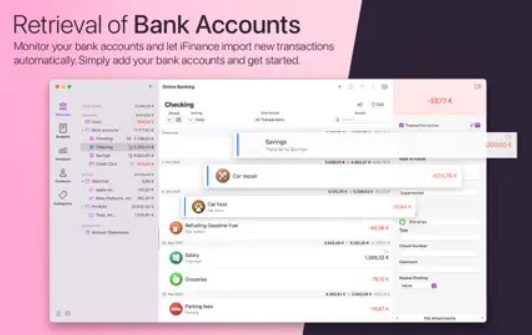

The next step is to link the app to your bank accounts and financial services providers. iFinance 5 has built-in support for hundreds of banks and allows you to connect using a secure API key or username/password combination.

Once connected, you’ll have access to your account information, such as statements, transactions, and balances.

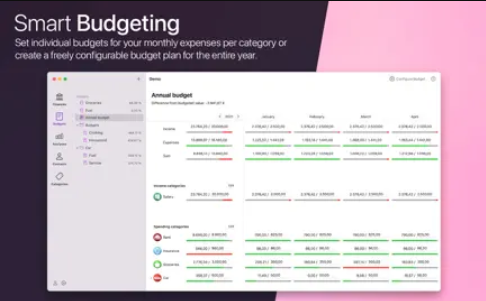

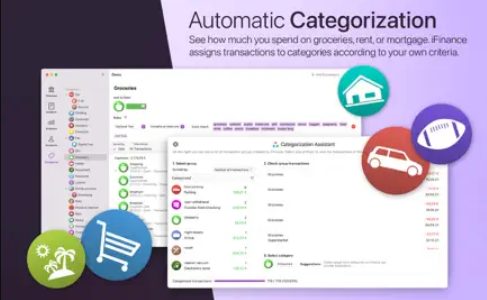

Finally, you’ll want to set up your budget in iFinance 5. This is done by assigning categories to each of your expenses so that you can track them more accurately. You can also create custom categories if needed. When setting budgets, factoring in your income, savings goals, and other long-term financial objectives is important.

How iFinance 5 works?

Once you’ve finished setting up your accounts and budgets, iFinance 5 will do the rest. The app will track your spending and investments, alert you to account changes, and provide powerful financial analysis tools.

You can generate reports based on specific categories or periods, keep track of all your bills and payments, and find ways to reduce expenses and save money.

iFinance 5 also lets you set reminders for upcoming bills so you won’t miss any payments. Plus, you can use the app to explore financial opportunities such as investments and loans.

With all this power at your fingertips, you’ll never have to worry about budgeting or to manage your finances again! All left is for you to start saving and investing smarter with iFinance 5.

The different features and benefits of iFinance 5

iFinance 5 offers a comprehensive suite of features that will help you easily track and manage your finances.

1. Automatic Bank Syncing:

The app can connect hundreds of banks and financial services providers, allowing you checking account balances, statements, and upcoming and overdue transactions in real time.

2. Budgeting Tools:

Create custom budget categories, set spending limits and savings goals, and track your progress over time.

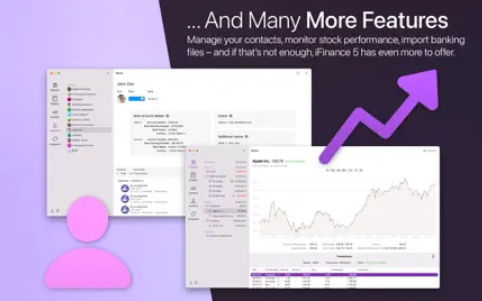

3. Investment Analysis:

Explore different investment opportunities such as stocks, bonds, mutual funds, and more. Get a detailed analysis of each option to help you make smart decisions with your money.

4. Bill Management:

Pay attention to every payment again with iFinance 5’s bill reminders. Keep track of all your bill payment and payments in one place for easy access.

5. Powerful Reports:

Generate detailed financial reports based on different periods and categories to gain insights into your spending habits.

6. Bank-Grade Encryption:

All of your data is secured with bank-grade encryption, so you can rest assured that your information is safe and secure.

7. Intuitive Interface:

The app’s intuitive interface makes navigating easy and finding the features you need quickly. Plus, iFinance 5 is constantly updated with new features to simplify managing your finances.

How to use the budgeting tool to create a savings plan

iFinance 5 has a powerful budgeting feature to help you set savings goals and track progress. The interface is simple, allowing you to easily enter your monthly income target and expenses. After paying your bills, you can see how much money you have left over and start building up an emergency fund or saving for a big purchase.

The budgeting tool keeps your goals in check and helps you stay on top of your finances. With its comprehensive reports, you can easily spot where your money is going each month to make informed decisions about how to allocate it in the future.

Tips for reducing expenses and managing debt

1. iFinance 5’s budget planner helps you create and track a budget to easily identify areas where you could save money. It also has tools for reducing expenses, such as setting spending limits and tracking your progress toward financial goals.

2. Additionally, iFinance 5 has a debt tracker. This feature allows you to see an overview of your debts, plan for repayment, and track payments to ensure your debt load is being managed responsibly.

3. With iFinance 5’s budgeting, expense tracking, and debt management tools, you can understand your finances comprehensively, stay in control of debt, and identify areas where you could be saving money.

4. Lastly, iFinance 5 provides professional advice and tips to help you stay on top of your finances. From how to set up a budget to strategies for paying down debt, it gives you the guidance and resources to make smarter financial decisions.

How to stay motivated while working on your finances?

iFinance 5 makes it easy to stay motivated. The app includes a tracker showing progress toward your financial goals, allowing you to see the steps you’re taking to achieve success.

You can also set reminders and alerts to help keep yourself on track with regular maintenance tasks. And when you hit a goal or milestone, iFinance 5 will reward you with virtual badges to celebrate your accomplishments!

What are the security features of iFinance 5?

Security and privacy are paramount for any finance app, so iFinance 5 utilizes bank-grade encryption technology. This ensures that your year round financial planning data is kept secure and protected from hackers or thieves.

Additionally, the app has two-factor authentication and will prompt you to enter a secure access code when accessing the app from any device. These features are designed to give you peace of mind that your information is safe and secure on iFinance 5.

What kind of reports can be generated with iFinance 5?

iFinance 5 makes it easy to create detailed reports of your finances and spending. The app can generate visual reports and a variety of custom reports for you, including expense summaries and other financial resources.

You can even compare expenses over time to gain greater insight into your spending habits. With all of these options, iFinance 5 provides the data that you need to make informed decisions about your finances.

With iFinance 5, you can take control of your financial life and make the most of your money. Download the app today and start managing your finances in a powerful, yet intuitive way!

Conclusion:

iFinance 5 is the ultimate finance management app that puts all your financial information in one convenient place. Its intuitive interface and powerful features make budgeting and investment tracking expenses easy.

Its bank-grade encryption technology ensures that all your data is kept secure. With iFinance 5, you can take control of your personal finances and make smart financial decisions. Start using it today and watch your money grow!

FAQ’s

What makes iFinance 5 different from other financial management tools?

With iFinance 5, you have a comprehensive tool that enables you to access your accounts and offers tools for budgeting and forecasting, expense tracking, and more. And with its cross-platform compatibility, iFinance 5 is accessible from anywhere.

How does iFinance 5 keep my data secure?

Additionally, your accounts can be protected by a PIN code, which must be entered before access is granted. These measures ensure that your data remains safe and secure at all times.

How user-friendly is iFinance 5?

And with its powerful suite of software tools, you’ll be able to get a comprehensive view of your finances in no time. Plus, iFinance 5 is supported across all major platforms – so you can access and manage your account transactions wherever you are.

Does iFinance 5 offer a Wi-Fi sync option?

Download iFinance 5 app for: