In a world where the financial landscape is rapidly evolving, two fintech giants have emerged to revolutionize the way we manage money and make international transactions. Enter Revolut and TransferWise, two names that have taken the fintech industry by storm. In this battle of the fintech titans, we’ll dive deep into what makes these platforms tick and explore the pros and cons of each. So, let the showdown begin!

What is Revolut?

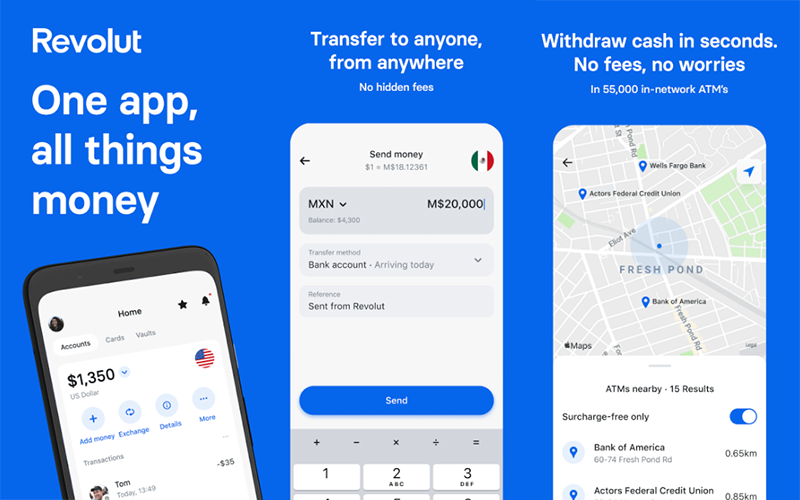

Revolut is a dynamic fintech platform that aims to simplify the way we handle our finances. Launched in 2015, it quickly gained popularity for its innovative approach to banking and money management. Unlike traditional banks, Revolut operates primarily through a mobile app, offering a range of services such as currency exchange, spending analytics, budgeting tools, and more.

How Does Revolut Work?

Get Revolut for:

Revolut’s core strength lies in its multi-currency accounts. Users can hold, exchange, and transfer money in multiple currencies at competitive exchange rates, making it an ideal choice for globetrotters and international businesses. With the premium subscription, you can even get access to cryptocurrency trading and other premium features.

Pros and Cons of Revolut

Pros:

- Multi-currency support for seamless international transactions.

- Real-time spending analytics to track your expenses.

- User-friendly mobile app for easy navigation.

- Competitive exchange rates.

- Cryptocurrency trading options.

- Quick and convenient account setup.

Cons:

- Limited customer support compared to traditional banks.

- Some premium features require a subscription.

- May not be available in all countries.

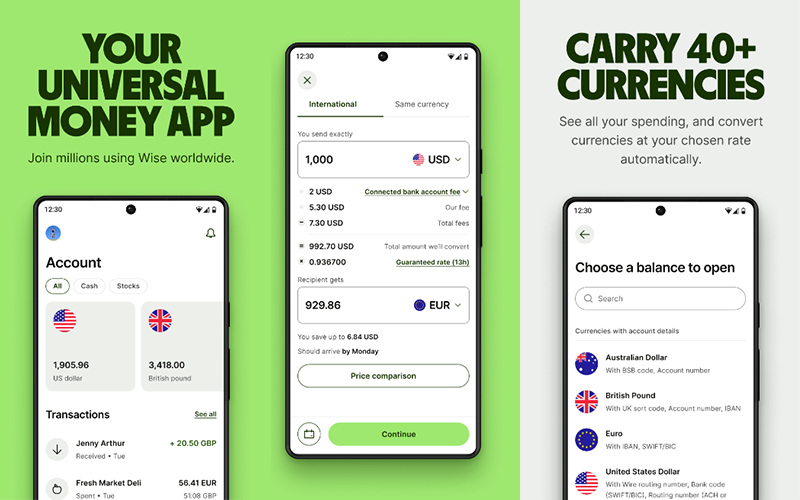

What is Wise?

Formerly known as TransferWise, Wise is another fintech behemoth that has redefined the way we send money abroad. Established in 2011, Wise’s mission is to make international money transfers cheaper, faster, and more transparent. It does this by using real exchange rates and minimal fees.

How Does Wise Work?

Get Wise for:

Wise operates as an online platform, allowing users to send money across borders with ease. The process is straightforward: you upload the amount you want to send, choose the recipient, and Wise handles the rest. They convert the money at the real exchange rate, ensuring you get more bang for your buck, and the recipient gets the exact amount you intended to send.

Pros and Cons of Wise

Pros:

- Real exchange rates with minimal fees.

- Transparency in pricing.

- Fast and reliable international transfers.

- Multicurrency account with a debit card option.

- Wide availability in various countries.

- User-friendly interface.

Cons:

- Primarily focused on international money transfers.

- Limited banking features compared to Revolut.

- Not designed for cryptocurrency trading.

Revolut vs. TransferWise

| Revolut | Wise | |

|---|---|---|

| Receiving Cost | Depends on the plan and allowance. Receiving payments is typically free. | Free. However, there is a fixed fee for receiving USD via wire, which is $4.14. |

| Sending Cost | Depends on the plan and allowance. $3/transfer international and $.2 per local payment. | Depends on the amount, how you pay, and the exchange rate. |

| Speed | 3-5 days. | 0-2 days. |

| Mobile App | Yes. | Yes. |

| Currencies | Hold and exchange 28 currencies. | Hold 50+ currencies in your account. |

| Prepaid Card | Up to 20 Revolut cards per team. | Wise debit card. |

| International Payments | Spend like a local in 150 different currencies. | Receive payments like a local in 10 currencies. |

| Taxes | All taxes are your responsibility to report. | Does not report to HMRC or any other tax authority. |

| Mass Payments | Bulk payments – upload a bulk file for quick mass payments. | Send multiple transfers with the Batch Payments tool. |

| Security | Not covered by FSCS, but acquired a European Banking License in 2018. | Not covered by FSCS, but acquired a European Banking License in 2018. |

In conclusion, the battle of the fintech titans between Revolut and Wise showcases two distinct approaches to modern banking and international money management. Revolut excels in its comprehensive range of services, offering not only international money transfers but also features like cryptocurrency trading and spending analytics. On the other hand, Wise shines in its dedication to making international money transfers cheaper and more transparent, without the bells and whistles of a full-fledged banking app.

The choice between Revolut and Wise ultimately depends on your financial needs and priorities. Are you looking for an all-in-one banking solution with a wide array of features, or do you need a reliable platform for seamless international transfers? Either way, these fintech titans are here to make your financial life easier, and the battle continues to drive innovation in the world of finance.